Pages

I AM...

Followers

Saturday, June 30, 2007

TRAIN OF LIFE...

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Friday, June 29, 2007

RESENMENT: DEMOLISHING ANGER’S WALLS

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Thursday, June 28, 2007

THE TEAR...

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Wednesday, June 27, 2007

NATIONAL H. I. V. TESTING DAY

On this day, HIV testing sites and AIDS service providers around the globe will participate in events for National HIV Testing Day. These activities will include health fairs, community education, special events, and extended testing hours.

National HIV Testing Day is critical to the fight against HIV/AIDS because it presents an opportunity for people nationwide to learn their HIV status, and to gain the knowledge they need to take control of their health and their lives. National HIV Testing Day also provides an invaluable opportunity to dispel the myths and stigma associated with HIV testing, and to reach those who have never been tested or who have engaged in high-risk behavior since their last test.

More than one million persons have HIV and many do not even know it. With improved treatment and care, people are now living with HIV/AIDS. However, this life saving treatment never reaches people who do not know they are infected. Knowing your HIV status is the best way to help win the fight against AIDS.

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Tuesday, June 26, 2007

PRESENTING MR. AND MR. BROOKINS-LEONARD

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Monday, June 25, 2007

WOMEN: BECOMING THEIR OWN ROLE MODELS

As women embrace the fullness of who they are as individuals, they may find themselves supporting other women, helping others to reach the level of inner comfort and outer freedom that they themselves have found. Among those who are less sure of themselves and their place in the world, it may be more common to criticize other women than to seek their help. But there are things that a woman can only learn from another woman, as there are things about being a man that can only be learned from other men. We all recognize that we have much to learn from each other regardless of gender, but sometimes we could use a supportive role model that gives us a more precise example of what and who we can become. There was a time where women stood together in a bond of sisterhood, women supporting women. It is only natural that the pendulum swings out of balance for a while so that we may have the experience of what we do not want. It is up to women to bring the pendulum back into balance and bring back the sacred sisterhood we yearn for at our core. If we envision a world where women support each other and help each other find their place in an ever-changing world, then we can become the change we want to see. Jealousy, envy, criticism, and judgment are refuges for the insecure. As we help others to become self-assured, we create a world in which all people help each other, regardless of gender. Only women can make the change in how women are seen and understood, not just by other women but by the world at large. The way we speak about each other to other women and to the men in our lives informs everyone to treat us with the respect that all women, and all people, deserve.

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Sunday, June 24, 2007

A WORD FROM MS. ALEXYSS TYLOR

[youtube http://www.youtube.com/watch?v=ssOiYx0_e7c]

[youtube http://www.youtube.com/watch?v=JdGJxI6LrX4]

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Saturday, June 23, 2007

5 SIGNS HE IS CHEATING:

- Suspicious Computer Activity - These days, it's easy to meet men in chat rooms, forums or on instant messenger. Have you seen a suspicious name in your IM window or an unknown chat site in your browser history? A little digging can go a long way. Be careful trying to be a super snooper, though, and give your man space. It's just as easy to meet friends online as it is love interests. Your partner may just be reaching out for other gay people to talk to.

- Sudden Changes in Schedule - Some men may be spontaneous, but most of us keep a set schedule or standard routine in some form or another. This is especially true for day-to-day activities. Has your man's routine suddenly changed without you knowing why? Did his working hours increase or does he have a new gym schedule? Things often change in our lives. In turn, we decide to try and impress our bosses by working overtime or resolve that it's finally time to get into shape. But what raises suspicion is how these changes are communicated to you. Was the decision made without your input? Was there an attempt to include you? Are there any signs of progress?

- Emotional Distance - It's normal for the intensity of your relationship to decrease after you've been together for a while. There may have been a time when you couldn't bare to leave each others' sight and now you both enjoy your time alone. This isn't a sign that he is cheating, only that the relationship is starting to settle into a loving and comfortable phase. Nonetheless, take note of any emotional distancing. Has he stopped listening or laughing? Does he seem distant or spacey, almost as if he's preoccupied? Take note if your partner is there physically, but not quite "there" mentally.

- Less Time Together - Just as the intensity of a relationship dwindles slightly over time, so may the time you spend together. But spending less time with each other shouldn't be confused with spending no time at all. Don't react too swiftly. Who knows, his company may be ready to close on a huge deal and they need him around the clock. Or there may be some other legitimate circumstance that demands his attention. Many huge time commitments like these don't last for long periods of time and make sense. He may be working 14 hour days, but does he also leave home on weekends? Look for the unreasonable and unexplainable time commitments.

- Instinct - Mother always said follow your instincts and this is a time when that motherly voice can come in handy. If your gut tells you that something is wrong or that some other guy has captured your man's attention, then go with it. But take caution with how far you follow these feelings. Ask yourself if they are legitimate concerns or if you yourself are lacking trust.

These tips are not meant to turn your trusting relationship into a game of hide and go seek and there are always exceptions. Trust first, but do not ignore the warning signs. If there are just too many inconsistencies for comfort, then communicate them to your man directly. Do not let him hear of your suspicions from a friend. Also, try not to be accusatory. Simply tell him how his behavior makes you feel. He may be dealing with other issues that have nothing to do with cheating on you with another man.

These tips are not meant to turn your trusting relationship into a game of hide and go seek and there are always exceptions. Trust first, but do not ignore the warning signs. If there are just too many inconsistencies for comfort, then communicate them to your man directly. Do not let him hear of your suspicions from a friend. Also, try not to be accusatory. Simply tell him how his behavior makes you feel. He may be dealing with other issues that have nothing to do with cheating on you with another man. I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Friday, June 22, 2007

H. I. V. ~ A. I. D. S. & THE INTIMATE CONNECTION

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Thursday, June 21, 2007

GAY BASHING/DEATH IN INDIANA

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Wednesday, June 20, 2007

WHAT WE SEE...JUDGING OTHERS

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Tuesday, June 19, 2007

BE FOR SOMETHING...

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Monday, June 18, 2007

WE THE "GAY" PEOPLE...

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Sunday, June 17, 2007

ON THIS DAY...

I want to be my father’s son.

Just for one day, for once in my life…

I would not stumble over,

Things blocking the path to an open door.

For my one wish, he did not make true.

He left me behind,

And did not leave his light to shine.

But in his heart,

The light I give will not depart.

If it takes forever and a day,

I know that he will come my way.

I am needed but not here,

Only when his path is dark

He can have me near.

So I would hold on to the memories when we first meet;

It was just the beginning,

I know that you love me,

You have shattered my world like a glass

As silence fills my loneliness

But burn with this desire

To tell you that I love;

And wish a happy father’s day.

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Saturday, June 16, 2007

THE WASTELAND

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Friday, June 15, 2007

PRO TIPS FOR A FLAT TUMMY

NUTRITION: This is the most important component to achieving a flat stomach. Nothing is more important than food. First, you'll need to control blood sugar levels in order to lose body fat. This is best accomplished by consuming four to six meals per day. Don't mistake the definition of a meal for a six-course extravaganza. A meal might be an egg white omelet (with vegetables) and oatmeal with some blueberries in it, chicken with one-half cup of rice and a large salad with some oil and vinegar, an apple with a scoop of protein powder or cottage cheese with some fruit. Get the picture? I'm referring to them as meals, but they're actually feedings. Each of the meals is comprised of protein, a little carbohydrate and a little fat. In some cases, the fat is built into the protein. In other cases, it's added to the meal. For E-Diets members, this is already accomplished in your meal plan.

NUTRITION: This is the most important component to achieving a flat stomach. Nothing is more important than food. First, you'll need to control blood sugar levels in order to lose body fat. This is best accomplished by consuming four to six meals per day. Don't mistake the definition of a meal for a six-course extravaganza. A meal might be an egg white omelet (with vegetables) and oatmeal with some blueberries in it, chicken with one-half cup of rice and a large salad with some oil and vinegar, an apple with a scoop of protein powder or cottage cheese with some fruit. Get the picture? I'm referring to them as meals, but they're actually feedings. Each of the meals is comprised of protein, a little carbohydrate and a little fat. In some cases, the fat is built into the protein. In other cases, it's added to the meal. For E-Diets members, this is already accomplished in your meal plan.

RATIOS: It's unlikely that you'll get tight abs and a flat stomach by consuming 80 percent of your calories from carbohydrates. Ratios can vary quite a bit, but consuming more than 55 percent of your calories from carbohydrate will not be optimal for fat loss. Many people do quite well on extremely low carbohydrate plans and others on more moderate plans. As long as you follow the no more than 55 percent of calories from carbohydrate rule, you'll be at a good starting point.

TIMING: It (the body) doesn't care if you want to lose fat. In fact, your body would prefer to keep fat in order to accomplish its number one goal of keeping you alive in case of a future famine or drought. Always consider the body from the inside out and not the other way around. In order to control blood sugar, eat every two to three hours throughout the day. When using the most effective nutrient ratios, this helps to control blood sugar (which, in turn, assists in body fat loss).

CALORIES: It doesn't matter how healthy your nutrition program is, it's important that you find maintenance calories first. Maintenance represents the amount of food you consume without any change in your weight. This will take some experimentation and some effort. You'll also need to document your foods: total calories as well as grams of protein, carbohydrates and fats. Sounds like a lot of work? Yes, it is! However, you only have to do a few weeks of hard work. After that, you'll have your personal formula for success.

SLIGHT CALORIC DEFICIT: After you have found maintenance, simply reduce your calories by 200. Our goal is to have you eating as much as possible and still losing fat and retaining muscle. I don't want you eating as little as possible (thereby slowing the metabolism and losing valuable muscle tissue). The first week, you may lose 4-6 pounds of water. After the first week, you should only lose about 1.5 pounds per week. The goal is to preserve muscle and make your body a metabolic inferno. If you're not losing up to 1.5 pounds per week (it will fluctuate week to week), then reduce calories by another 100. Then, monitor your progress after one week. You'll probably be right on track.

CONSISTENCY: You'll need to be on this nutrition program six days a week with one day being somewhat of a cheat day. Unlike many, I'm not a big fan of the "cheat" day. I find that people tend to use it as an excuse to gorge themselves. So, on Sunday for example, you're allowed to have some pizza, a bit of ice cream, etc. But nothing extreme! When you pig out, blood sugar levels can be elevated for seven hours or more. This will absolutely halt your body fat loss and actually backfire.

WEIGHT TRAIN: At this point, you should be aware of the importance of resistance training. Just three to four workout sessions lasting no more than 35 minutes to an hour will do the trick. For every pound of muscle on your body, you'll burn 30-50 additional calories per day. Part of your program should include abdominal exercises to strengthen and build the abs. That way, when you achieve your low body fat level, your abs will be tight.

CARDIOVASCULAR EXERCISE: Perform three to five days per week of moderate cardio exercise for approximately 30-40 minutes. During two of the days, you can exercise at a higher intensity level to accelerate fat loss -- but, only if you reach a sticking point. If you're a beginner, then remember to increase gradually. Do this consistently, keep adjusting calories SLIGHTLY (with the help of our nutrition support staff and the specific nutrition program you selected from the site) and change your routine every three to four weeks. You will get a flatter stomach!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Thursday, June 14, 2007

¿CAPITAL PUNISHMENT = RETRIBUTION?

The journey that each human being makes through earthly existence can have hardship as often as it is touched by joy. In truth, there is no situation so dire, no challenge so great, and no choice so bewildering than the argument over capital punishment. Here in the Bahamas and all of over the world we have persons that have their lives cut short or end abruptly by the hands of another. I firmly believe that NO ONE dies before his or her time, this is all apart of GOD’S GRAND DESIGN, and things just play themselves out like the sun rising in the east and setting in the west. I cannot understand or comprehend why murder and other social ills plague our planet in the way it does but I know somehow some way that this is all for a purpose. LIKE THE MAXTRIX SAID, ‘THE CHOICE HAS ALREADY BEEN MADE; WE ARE HERE TRYING TO UNDERSTAND IT.’ I love that quote because it says so much about how our lives progress and what goes into shaping them. I do not doubt for a second that the bum on street is meant to be that, I do not doubt that people are going to be poor; in this same vain I not even for a moment doubt that the social ills that we battle with are suppose to be there. Life is precious and tender and we should appreciate it as such, but we spend so much time not caring about each other that it makes me sad to think that we only feel for our fellow man when they are no longer around. I BELIEVE THAT EVERYTHING ON THIS PLANET SHOULD BE SACRED AND ADORED. However that is not the case, and the worst thing that can happen to us is the lost of love via the hands of another. I in no shape, form or fashion uphold the thought or notion of an individual taking away someone’s life; in the same vain I am not an advocate for them being killed for doing as well. Now the strange thing about is that I am not in support of capital punishment but I at the same time understand why we have persons that are. Nonetheless, my focus is on SOUL RETRIBUTION and getting to the root of the problem. It is my personal belief that CAPITAL PUNISHMENT does not solve anything; it just gives the public what they think they want and PERMANENTLY removes the worst criminals from society. This makes PERFECT sense since it is evident that dead criminals cannot commit any further crimes, but what happens to the ENERGY that is created by this act? Does killing a killer cancel out that energy that he created? Or is this energy further compounded because we the people want resolutions to problems that were created long before the act itself? It is a well-known and documented fact that convicted murders have troubled childhoods and thus are mentally scarred for life. SEXUAL, VERBAL, MENTAL and PHYSICAL ABUSE are just some of things that are handed out to individuals that grow to commit acts of murder and alike. How can we not see how broken our world is when you have persons walking among us that need help and we do nothing to correct the situation? Our first instinct is to kill because that’s what they did, but doesn’t that make you just like the persons that made them this way in the first place? The thing is that when society is seeking payment for what WRONG was done they try to justify themselves and soothe their souls by thinking that this right thing to do in the name of RETRIBUTION. It is said that our prisons are crowded and it’s drain on the tax-payers, they go on to say how this system doesn’t deter criminal activity on this level. They feel that we need RETRIBUTION and it is to be done by any means necessary as long as the criminal is taken out. But does the death penalty deter further criminal activity? Even though it is hard to prove one way or the other; so if you are bitten from a snake isn’t the cure anti-venom which is made from the venom of the snake the bit you? So in my opinion THE DEATH PENALTY IS FLAWED AND DELIBERATELY MISLEADING. It makes society think that they have control over this activity when it was born long before it got to this stage. I FIRMLY BELIEVE THAT THERE ARE NO BAD PEOPLE IN THE WORLD; WE ARE ALL A PRODUCT OF ELEMENTS THAT WE’VE MET HERE AND THEY ARE THE THINGS THAT CAN MAKE OR BREAK US. And no one takes into consideration what hell the innocent family and friends of criminals must also go through in the time leading up to and during the execution and which will often cause them serious trauma for years afterwards. This is no way trying to away from the crime they committed but honestly think about it, this is a double whammy and this is more of a burden to bear. How can one not realize that this it is very difficult for persons to come to terms with the fact that their loved did such a thing? I say, HOWEVER STONGLY YOU MAY SUPPORT CAPITAL PUNISHMENT, TWO WRONGS DON’T MAKE ONE RIGHT! One cannot and should not deny the suffering of the victim's family in a murder case but the suffering of the murderer's family is equally valid. I know it’s difficult but we must remember that criminals are real people too and society continuously put this thought on the side lines only thinking about the awful activity that was done. Thus they only want one thing and it makes me wonder if this is for them or the person that they lost? Why are they so hell bent on seeking this sort of comfort and we all know that there is no such thing as a humane method of putting a person to death? Every form of execution causes suffering and its very terrifying; and a gruesome ordeal. How can they overlook the extreme mental torture and suffering that is placed on such a human being? How can they really feel good about RIGHTING A WRONG in this manner? So this means that A DEATH FOR A DEATH indicates that things are all good and fine? Do they think that the victim is smiling and saying thank you, my soul is at peace? I THINK NOT! The death penalty is the bluntest of "blunt instruments," it removes the individual's humanity and with it any chance of rehabilitation and their giving something back to society. It’s scary to think that persons out are just out for BLOOD and disguise it as JUSTICE. Do you think they sit back and think yeah mission accomplished? ONLY UNTIL THE NEXT CRIME IS COMMITTED THEN THE WITCH HUNT BEGINS. Do they realize that the death penalty can’t deter worst murderers because they are typically psychopaths and filled with such dubious sanity that they are incapable of rational behaviour due to linkages in their past or present? SO THE HANDFUL OF EXECUTIONS HERE AND THERE DOES NOTHING BUT APPEASE THE MASSES FOR A TIME. I know that if they were to declare ware on criminals in this fashion we would see a rapid decline in serious crime but at what cost in human terms? I GUESS CRIMINALLY INCLINE HUMAN BEINGS ARE THAT SICK AND EVIL. If the general conclusion is that capital punishment is desirable, I wonder if in another hundred years we will, as a world still has capital punishment or whether we will have evolved technological means of detecting and correcting potential criminals before they can actually commit any crime. Punishment will remain popular with the general public as long as there are no viable alternatives and as long as crime continues its rise. Logically, however, punishment of any sort cannot be the future and if we hope to progress we have to find other means of dealing with this social ill. Until the utopian point is reached, I think that we will continue to see the same things being done to solve this problem. I will never accept the fact that the majority of people who support capital punishment do so for sadistic reasons but rather out of a feeling of desperation that they are overwhelm by such activity that they cannot deal. But to that I say, WE ARE ONLY HEALING A PORTION OF THE PROBLEM; IF WE WERE TO THINK LONG-TERM, I THINK THAT WE WOULD SEE THE FUTURE CLEARLY.

The journey that each human being makes through earthly existence can have hardship as often as it is touched by joy. In truth, there is no situation so dire, no challenge so great, and no choice so bewildering than the argument over capital punishment. Here in the Bahamas and all of over the world we have persons that have their lives cut short or end abruptly by the hands of another. I firmly believe that NO ONE dies before his or her time, this is all apart of GOD’S GRAND DESIGN, and things just play themselves out like the sun rising in the east and setting in the west. I cannot understand or comprehend why murder and other social ills plague our planet in the way it does but I know somehow some way that this is all for a purpose. LIKE THE MAXTRIX SAID, ‘THE CHOICE HAS ALREADY BEEN MADE; WE ARE HERE TRYING TO UNDERSTAND IT.’ I love that quote because it says so much about how our lives progress and what goes into shaping them. I do not doubt for a second that the bum on street is meant to be that, I do not doubt that people are going to be poor; in this same vain I not even for a moment doubt that the social ills that we battle with are suppose to be there. Life is precious and tender and we should appreciate it as such, but we spend so much time not caring about each other that it makes me sad to think that we only feel for our fellow man when they are no longer around. I BELIEVE THAT EVERYTHING ON THIS PLANET SHOULD BE SACRED AND ADORED. However that is not the case, and the worst thing that can happen to us is the lost of love via the hands of another. I in no shape, form or fashion uphold the thought or notion of an individual taking away someone’s life; in the same vain I am not an advocate for them being killed for doing as well. Now the strange thing about is that I am not in support of capital punishment but I at the same time understand why we have persons that are. Nonetheless, my focus is on SOUL RETRIBUTION and getting to the root of the problem. It is my personal belief that CAPITAL PUNISHMENT does not solve anything; it just gives the public what they think they want and PERMANENTLY removes the worst criminals from society. This makes PERFECT sense since it is evident that dead criminals cannot commit any further crimes, but what happens to the ENERGY that is created by this act? Does killing a killer cancel out that energy that he created? Or is this energy further compounded because we the people want resolutions to problems that were created long before the act itself? It is a well-known and documented fact that convicted murders have troubled childhoods and thus are mentally scarred for life. SEXUAL, VERBAL, MENTAL and PHYSICAL ABUSE are just some of things that are handed out to individuals that grow to commit acts of murder and alike. How can we not see how broken our world is when you have persons walking among us that need help and we do nothing to correct the situation? Our first instinct is to kill because that’s what they did, but doesn’t that make you just like the persons that made them this way in the first place? The thing is that when society is seeking payment for what WRONG was done they try to justify themselves and soothe their souls by thinking that this right thing to do in the name of RETRIBUTION. It is said that our prisons are crowded and it’s drain on the tax-payers, they go on to say how this system doesn’t deter criminal activity on this level. They feel that we need RETRIBUTION and it is to be done by any means necessary as long as the criminal is taken out. But does the death penalty deter further criminal activity? Even though it is hard to prove one way or the other; so if you are bitten from a snake isn’t the cure anti-venom which is made from the venom of the snake the bit you? So in my opinion THE DEATH PENALTY IS FLAWED AND DELIBERATELY MISLEADING. It makes society think that they have control over this activity when it was born long before it got to this stage. I FIRMLY BELIEVE THAT THERE ARE NO BAD PEOPLE IN THE WORLD; WE ARE ALL A PRODUCT OF ELEMENTS THAT WE’VE MET HERE AND THEY ARE THE THINGS THAT CAN MAKE OR BREAK US. And no one takes into consideration what hell the innocent family and friends of criminals must also go through in the time leading up to and during the execution and which will often cause them serious trauma for years afterwards. This is no way trying to away from the crime they committed but honestly think about it, this is a double whammy and this is more of a burden to bear. How can one not realize that this it is very difficult for persons to come to terms with the fact that their loved did such a thing? I say, HOWEVER STONGLY YOU MAY SUPPORT CAPITAL PUNISHMENT, TWO WRONGS DON’T MAKE ONE RIGHT! One cannot and should not deny the suffering of the victim's family in a murder case but the suffering of the murderer's family is equally valid. I know it’s difficult but we must remember that criminals are real people too and society continuously put this thought on the side lines only thinking about the awful activity that was done. Thus they only want one thing and it makes me wonder if this is for them or the person that they lost? Why are they so hell bent on seeking this sort of comfort and we all know that there is no such thing as a humane method of putting a person to death? Every form of execution causes suffering and its very terrifying; and a gruesome ordeal. How can they overlook the extreme mental torture and suffering that is placed on such a human being? How can they really feel good about RIGHTING A WRONG in this manner? So this means that A DEATH FOR A DEATH indicates that things are all good and fine? Do they think that the victim is smiling and saying thank you, my soul is at peace? I THINK NOT! The death penalty is the bluntest of "blunt instruments," it removes the individual's humanity and with it any chance of rehabilitation and their giving something back to society. It’s scary to think that persons out are just out for BLOOD and disguise it as JUSTICE. Do you think they sit back and think yeah mission accomplished? ONLY UNTIL THE NEXT CRIME IS COMMITTED THEN THE WITCH HUNT BEGINS. Do they realize that the death penalty can’t deter worst murderers because they are typically psychopaths and filled with such dubious sanity that they are incapable of rational behaviour due to linkages in their past or present? SO THE HANDFUL OF EXECUTIONS HERE AND THERE DOES NOTHING BUT APPEASE THE MASSES FOR A TIME. I know that if they were to declare ware on criminals in this fashion we would see a rapid decline in serious crime but at what cost in human terms? I GUESS CRIMINALLY INCLINE HUMAN BEINGS ARE THAT SICK AND EVIL. If the general conclusion is that capital punishment is desirable, I wonder if in another hundred years we will, as a world still has capital punishment or whether we will have evolved technological means of detecting and correcting potential criminals before they can actually commit any crime. Punishment will remain popular with the general public as long as there are no viable alternatives and as long as crime continues its rise. Logically, however, punishment of any sort cannot be the future and if we hope to progress we have to find other means of dealing with this social ill. Until the utopian point is reached, I think that we will continue to see the same things being done to solve this problem. I will never accept the fact that the majority of people who support capital punishment do so for sadistic reasons but rather out of a feeling of desperation that they are overwhelm by such activity that they cannot deal. But to that I say, WE ARE ONLY HEALING A PORTION OF THE PROBLEM; IF WE WERE TO THINK LONG-TERM, I THINK THAT WE WOULD SEE THE FUTURE CLEARLY. I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Wednesday, June 13, 2007

ETERNITY...

HAVE YOU NOTICE WHAT A FAIRYLAND WE LOST WHEN WE STOPPED BELIEVING IN ETERNITY? If to-day the word Eternity was written in the sky or placed on billboards around town, everyone would be gazing at it try to recall what it used to signify. The word reminds us how we used to slip away from hurry to bathe in a sea of timelessness, refreshing to every taut nerve. In eternity, we should be no longer the puny spawn of monkeys, but beings good, great, and glorious as angels. Eternity is filled with shining lights, with majestic figures from the past walking its wondrous streets. Our physical self on this planet has so many burdens on our souls and we have no control over its demands. As a result, many persons unconsciously long to escape the confinement of their bodies opting not to deal with the discomfort and rigors of their day-to-day existence. Nonetheless, we inhabit our bodies for a reason and there is a lot we can learn in this human body that we could not have grasped had we remained in spirit form. Thus, this is a vital plateau in the progression of becoming enlightened beings. Now it seems that no one believes we live after we die. We all live as if what happens here just haphazardly occurs and there is no connection to anything, but I beg to differ. Our survival on this planet came because we maintained dominance over everything around us and it is such a shame that we now are trying to dominate each other. I cannot say that I blame because ETERNITY does not exist and we are ALL insignificant beings on this earth. Hence, why should BEINGS like us go about loving each other as if we were GODS? Why we waste OUR time caring for OUR fellow man whose breath of wind can be snuff out like a flame? So I wonder how is it we have lost OUR ETERNITY? How did we loose the thing that OUR SOULS are tied to? We have forgotten that we will leave our physical selves behind to return to our original state, we will enjoy a supreme sense of freedom-yet we will always value the time we spent on earth. So why live as if we do not want to live forever? Why don’t WE see the BIGGER PICTURE? The world is sad really, we have lost eternity, and we cannot seem to bring it back. Oddly enough, we do not want to bring it back, we have discovered some way of being comfortable without it. So I ask, why not have a little patience with ourselves? We poor devils who have to bear all the brunt of the transition from life to eternity, if we promise not to corrupt ourselves. It is such a pity that we cannot safely play in this chapter of life.

HAVE YOU NOTICE WHAT A FAIRYLAND WE LOST WHEN WE STOPPED BELIEVING IN ETERNITY? If to-day the word Eternity was written in the sky or placed on billboards around town, everyone would be gazing at it try to recall what it used to signify. The word reminds us how we used to slip away from hurry to bathe in a sea of timelessness, refreshing to every taut nerve. In eternity, we should be no longer the puny spawn of monkeys, but beings good, great, and glorious as angels. Eternity is filled with shining lights, with majestic figures from the past walking its wondrous streets. Our physical self on this planet has so many burdens on our souls and we have no control over its demands. As a result, many persons unconsciously long to escape the confinement of their bodies opting not to deal with the discomfort and rigors of their day-to-day existence. Nonetheless, we inhabit our bodies for a reason and there is a lot we can learn in this human body that we could not have grasped had we remained in spirit form. Thus, this is a vital plateau in the progression of becoming enlightened beings. Now it seems that no one believes we live after we die. We all live as if what happens here just haphazardly occurs and there is no connection to anything, but I beg to differ. Our survival on this planet came because we maintained dominance over everything around us and it is such a shame that we now are trying to dominate each other. I cannot say that I blame because ETERNITY does not exist and we are ALL insignificant beings on this earth. Hence, why should BEINGS like us go about loving each other as if we were GODS? Why we waste OUR time caring for OUR fellow man whose breath of wind can be snuff out like a flame? So I wonder how is it we have lost OUR ETERNITY? How did we loose the thing that OUR SOULS are tied to? We have forgotten that we will leave our physical selves behind to return to our original state, we will enjoy a supreme sense of freedom-yet we will always value the time we spent on earth. So why live as if we do not want to live forever? Why don’t WE see the BIGGER PICTURE? The world is sad really, we have lost eternity, and we cannot seem to bring it back. Oddly enough, we do not want to bring it back, we have discovered some way of being comfortable without it. So I ask, why not have a little patience with ourselves? We poor devils who have to bear all the brunt of the transition from life to eternity, if we promise not to corrupt ourselves. It is such a pity that we cannot safely play in this chapter of life.  I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Tuesday, June 12, 2007

GAY VOYAGERS!

We GAY VOYAGERS came into this world handicapped by the very life that we are given; only to be taunt and teased by the thoughts of happiness that dangles rigth before our eyes in the form of IGNORANCE. This ignorance shows itself everyday and my friends and I got a taste of it this past Saturday while out enjoying each other’s company. There was this boy that proceeded to bodly say that we are THE CONCH SALAD CREW. Now I heard him and stopped him dead in his tracks and he was quite shocked and puzzled because he thought that he’d met a group of TYPICAL GAY PEOPLE; HELL NO! He met GAY VOYAGERS that knows that THIS SH!T IS OURS AND WE OWN THIS B!TCH…LOCK, STOCK AND TWO F&CKING BARRELS…But interesting enough, he seems to have the notion that when he visits, he is the prince of this kingdom living in the land of fun @ our expense. Such a silly boy, does he know that the fact that he came to OUR kingdom that makes him one of us? Does he know that from that moment on whether he stayed or left we knew that he was OURS? This human soul demands respect and it’ll sacrifice individuals to achieve such a cause. Little does he know, but we are all the same and we all have the same desires in life. Nonetheless, I am constantly astounded by the contrast between my view of HIM and his view of HIMSELF. Acceptance is the bridge that connect him between INGORANCE and INTELLEGENCE. He knows deep in himself that in truth his opinion suffers from the lie of the label he place on it. But he isn’t alone, the world is against us as well. We belong to them no longer our own; we are slaves of their own self-doubt. In their minds we are just the chattels of life, the whisper in the air. But our unshackled egos on that day showed him our true voice. We took the road that talked and HE got OUR message loud and clear; WE WILL NOT PAY THE PENALTY OF BEING UNIQUE, OF BEING AN ANOMALY IN THIS WORLD! I’ve waited for this day and in the past I use to allow myself to just take this HATRED and say that it’s ACCEPTED and EXPECTED because of MY SEXUAL PREFERENCE. So now our time has come and our day of PRIDE came and I was happy to be apart of it. The light of HOPE that I sought for years on end finally shown down on us and we finally removed the eyelids that might cease to see the flashing mystery of darkness that surrounded us. Funny how I had walked this road many times and never had this outcome; now the tables have turned and it’s my turn to finally get what I’ve been yearning for. For far too long my world lay in mist; engulfed in a fog. Now I am watching the sun steadily shining through, shredding the mist of ignorance and hatred. For far too long I was like an infant lying helplessly while demons played hide-and-seek with my soul. Now I stand in HIS sight naked of all accidental social trappings; VICTORY IS A B!TCH. this moment is HEART-REVEALING especially when I think of the crimes and inhumane things committed in the name of rightoeusness. I WAS BORN BENEATH A BANNER I DID NOT CHOOSE, BUT LIKE MANY OTHERS LIKE MYSELF, I HAVE GROWN FROM A MERE INFANT TO A STRONG HOMOSEXUAL MAN. I NOW KNOW WHY I FELT DISTRAUGHT WHEN THE ANGELS OF BIRTH DROPPED ME IN THE TENTS OF THE UNFORGIVEN, THE UNLOVED…THE UNWANTED. I THANK GOD EVERYDAY THAT I AM WHO I AM, FOR THIS VERY REASON I AM A WHOLE AND RECONCILED BEING.

We GAY VOYAGERS came into this world handicapped by the very life that we are given; only to be taunt and teased by the thoughts of happiness that dangles rigth before our eyes in the form of IGNORANCE. This ignorance shows itself everyday and my friends and I got a taste of it this past Saturday while out enjoying each other’s company. There was this boy that proceeded to bodly say that we are THE CONCH SALAD CREW. Now I heard him and stopped him dead in his tracks and he was quite shocked and puzzled because he thought that he’d met a group of TYPICAL GAY PEOPLE; HELL NO! He met GAY VOYAGERS that knows that THIS SH!T IS OURS AND WE OWN THIS B!TCH…LOCK, STOCK AND TWO F&CKING BARRELS…But interesting enough, he seems to have the notion that when he visits, he is the prince of this kingdom living in the land of fun @ our expense. Such a silly boy, does he know that the fact that he came to OUR kingdom that makes him one of us? Does he know that from that moment on whether he stayed or left we knew that he was OURS? This human soul demands respect and it’ll sacrifice individuals to achieve such a cause. Little does he know, but we are all the same and we all have the same desires in life. Nonetheless, I am constantly astounded by the contrast between my view of HIM and his view of HIMSELF. Acceptance is the bridge that connect him between INGORANCE and INTELLEGENCE. He knows deep in himself that in truth his opinion suffers from the lie of the label he place on it. But he isn’t alone, the world is against us as well. We belong to them no longer our own; we are slaves of their own self-doubt. In their minds we are just the chattels of life, the whisper in the air. But our unshackled egos on that day showed him our true voice. We took the road that talked and HE got OUR message loud and clear; WE WILL NOT PAY THE PENALTY OF BEING UNIQUE, OF BEING AN ANOMALY IN THIS WORLD! I’ve waited for this day and in the past I use to allow myself to just take this HATRED and say that it’s ACCEPTED and EXPECTED because of MY SEXUAL PREFERENCE. So now our time has come and our day of PRIDE came and I was happy to be apart of it. The light of HOPE that I sought for years on end finally shown down on us and we finally removed the eyelids that might cease to see the flashing mystery of darkness that surrounded us. Funny how I had walked this road many times and never had this outcome; now the tables have turned and it’s my turn to finally get what I’ve been yearning for. For far too long my world lay in mist; engulfed in a fog. Now I am watching the sun steadily shining through, shredding the mist of ignorance and hatred. For far too long I was like an infant lying helplessly while demons played hide-and-seek with my soul. Now I stand in HIS sight naked of all accidental social trappings; VICTORY IS A B!TCH. this moment is HEART-REVEALING especially when I think of the crimes and inhumane things committed in the name of rightoeusness. I WAS BORN BENEATH A BANNER I DID NOT CHOOSE, BUT LIKE MANY OTHERS LIKE MYSELF, I HAVE GROWN FROM A MERE INFANT TO A STRONG HOMOSEXUAL MAN. I NOW KNOW WHY I FELT DISTRAUGHT WHEN THE ANGELS OF BIRTH DROPPED ME IN THE TENTS OF THE UNFORGIVEN, THE UNLOVED…THE UNWANTED. I THANK GOD EVERYDAY THAT I AM WHO I AM, FOR THIS VERY REASON I AM A WHOLE AND RECONCILED BEING. I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Monday, June 11, 2007

EL MIEDO DEL HOMBRE

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Sunday, June 10, 2007

TEAR.ALONG.THE.DOTTED.LINE

No passed down culture;

No anchor to keep us from floating away.

There is no yesterday

And today is dressed in a designer clothing line

Sold as tomorrow.

We are disconnected. In one way, it is good.

We are able to make our own realities,

We are not locked into a perpetual cycle

Of what has already been.

However, we are locked in different cycles.

The vacuum has been filled.

It has been filled with crap.

Try to break the disconnect;

Stop poking ourselves in the eye.

Why I am I the connect?

Why am I stretch between two growling dogs?

Why can’t the future and past meet?

Why can’t we be of something?

We are lost beings going in random directions

Looking for something meaningful

But just end up at the barstool of life;

Surrounded by corpses.

Why don’t we know that the beautiful things make us?

Why I grind my teeth in anger?

Why do these things make me see that…?

Nothing is anything.

Tell me, is this normal?

Is this human?

Hell, I have no idea.

No one ever admits truth anymore

It pins them down,

They get uncomfortable,

And do something typical.

This is killing me.

This life is so obvious.

Too weak; too easy.

Nothing more than a tamed jalapeno,

Some of the flavor and none of the fire.

Maybe things get lost in translation,

Maybe things should get broken in shipping.

Maybe people get broken on the journey.

Maybe the fun part of life is trying to glue each other back together…

And the cycle goes back to the beginning.

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

Saturday, June 9, 2007

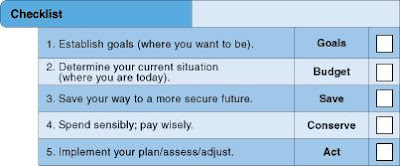

HOW TO BUDGET & SAVE

A few simple steps can make a big difference in making your money work harder for you.

ESTABLISH GOALS – WHERE DO YOU WANT TO BE?

Use the work sheets directly below to help you identify your goals. Print them and fill them in.

Without goals, it is difficult to accomplish anything. When you think about your future and what you want to achieve, it is helpful to establish a timeframe.

- Short-term: such as paying off credit card debt, saving for a vacation or buying new clothes.

- Intermediate: such as saving to buy a car.

- Long-term: such as saving for education or for retirement.

Estimate the cost of each goal and the date you want to achieve it. Then figure out how much you need to save each month. Try to set realistic goals and saving requirements.

CREATE A BUDGET. DETERMINE YOUR CURRENT SITUATION. WHERE ARE YOU TODAY?

Now that you have figured out your financial goals, you are ready to create a budget that will help you attain them. Print the budget work sheets below and write in your budget figures. Start by writing down your expenses (under Current Monthly Expenses).

MONTHLY FIXED EXPENSES – start with monthly fixed expenses such as regular savings, housing, groceries, utilities, and car payments. Put these continuing obligations under the heading: Fixed.

Use checking account statements, credit card statements, receipts and other records to help you complete this estimate. Be realistic - it is better to estimate high than low.

Remember that savings is considered an expense even though you keep the money. You work hard. You deserve to keep some of what you earn every month. Savings is the key to meeting your financial goals.

Make estimates for all money spent - regardless of how you pay: cash, check, credit card, debit card, automatic checking account withdrawals or savings through work plans such as retirement packages.

MONTHLY VARIABLE EXPENSES – once you have noted all your fixed expenses, write down your expenses that vary each month such as clothing, vacations, gifts and personal spending money. Put these expenses under the heading: Variable. You might have these expenses every month, but the amount you spend could change.

Get a handle on variable expenses by writing down every expense for a month - even small purchases. Use a small notebook or other informal method to track your spending. This is very important because it is the best way to understand your current spending behavior. Get receipts for all purchases - especially those you make with cash. Record and categorize each transaction. You may be surprised at how much you spend in certain categories.

Use a notebook to write down every purchase you make for one month. This is the best way to understand your current spending behavior.

List your monthly income

Now that you have figured out your expenses, write down your monthly income after all taxes and deductions. Write this under the heading: Monthly Income. Make sure this figure reflects the total take-home pay for your household after all taxes and deductions.

NOW COMPARE EXPENSES TO INCOME – one of the advantages of doing a comparison of expenses to income is that it provides a quick reality check. If you are spending more than you are bringing home every month in income, you have a deficit. If you are spending less than you are bringing home, you have a surplus. In either case, it is time to step back and consider some options.

If you have a deficit: Spending more than you are bringing home, ask yourself:

- Can I spend less in some of my variable expenses?

- How much interest am I paying with credit card and other loans?

- Where did my money go? (Consider writing down everything you spend for a month.

If you have a surplus: Spending less than you are bringing home, ask yourself:

- Am I saving enough to meet my goals?

- Are my spending estimates accurate?

- Have I included all my fixed and variable expenses?

SAVE YOUR WAY TO A MORE SECURE FUTURE

An estimated seventy-five percent of families will experience a major financial setback in any given ten-year period. The economy and the job market are good now, but that could change. It is smart to be prepared for financial thunderstorms.

SAVE EARLY, SAVE OFTEN – a consistent, long-term saving program can help you achieve your goals. It also can help you build a financial safety net. Experts recommend that you save from three to six months worth of living expenses for emergencies.

Savings grow beyond what you contribute because of compound interest. Over time, the value of compound interest works to every saver's advantage.

For example, if you save $75 a month for five years and earn five-percent interest, the $4,500 you contributed would grow to $5,122 because of the compounding interest.

It is easy to figure out how long it will take you to double the money you save. It's called the Rule of 72. You take the interest you are earning on your money and divide that number into 72. The result is roughly the number of years it will take your principal to double.

For example, if you are earning 5 percent on your money, you divide 72 by 5 and you get 14.4. Your principal will double in 14.4 years without further contributions.

Keep in mind, however, that inflation reduces the return on your money.

For example, five percent-interest, adjusted for three-percent inflation, only nets a two-percent real return.

WHAT YOU DON’T SEE, YOU DON’T SPEND – saving means giving up something now, so you will have more in the future. It is not easy deferring or eliminating purchasing things you want today.

It helps to pay yourself first. Take a portion of savings from every paycheck before you pay any bills. Use your company's payroll deduction plan if available. Arrange for a fixed amount to be taken out so that you never see it. What you do not see, you do not spend. You also can direct automatic checking account withdrawals into a savings account or money market.

Join the company's retirement-savings plan. Your contribution avoids current taxes and accumulates tax deferred. In addition, companies sometimes match some of your contributions.

For example, for every dollar you contribute, the company could contribute 25 cents. That would be a 25-percent return on your money.

OTHER SAVING TIPS:

- When you get a raise, save all or most of it.

- Pay off your credit card balances and save the money you're no longer spending on interest.

- Shift credit card balances to a card with a lower interest rate and use the savings to pay off the balance.

- Keep your car a year or two longer. Do routine maintenance and make regular repairs.

- Save the money you would have spent on a new car.

- Stop smoking.

- Take $5 from your wallet everyday and put it in a safe place. That will add up to $1,825 in a year.

- Shop with a list and stick to it.

- Don't buy any new clothes until you've paid off your current wardrobe.

- Eat more meals at home.

- Look for inexpensive entertainment: zoos, museums, parks, walks, biking, library books, concerts, movies and picnics.

- Shop for less expensive insurance.

- Drop subscriptions to publications you don't read.

- Postpone purchases or consider fewer features on the items you plan to purchase.

The less you spend, the more you can save. Moreover, the longer you can consistently save, the faster your savings will grow.

CONSERVE – SPEND SENSIBLY/PAY WISELY

Experts recommend paying with cash whenever possible. This helps you spend less than you otherwise would have spent if you had charged the purchase. You will also avoid credit card interest charges and check-cashing fees.

APPLYING FOR A CREDIT CARD – when you choose to apply for a credit card, shop carefully. There is a wide range of annual fees, interest rates, grace periods for which you do not pay interest, late fee charges, cash advance charges and other fees. Watch out for "teaser" rates that offer low rates initially but increase dramatically soon after.

To get a card with a low interest rate, you will first need to pay down your current debt. Second, let a year go by without applying for any new cards or loans, or accepting a higher credit limit on your current cards. Third, cancel cards you are not currently using. As a rule, limit yourself to two credit cards. Fourth, get a copy of your credit report and check it for accuracy.

CREDIT CARDS – Visa, MasterCard, and Discover are revolving-credit cards. You can charge up to a certain limit and carry most of the balance forward from month to month. Be careful about only paying the minimum amount due. This is a very expensive form of credit because of interest charges. The best rule is to charge only what you can afford to pay off in full every month. Then actually pay the entire balance when you get the bill.

When you are paying down credit card debt, start with the card with the highest interest rate. Pay your bills as quickly as possible.

ATM cards (Automated Teller Machine) are debit cards. They automatically withdraw money from your account.

Some consumers prefer to use debit cards rather than credit cards because debit cards don't incur interest charges.

PAYING OFF DEBT VS. SAVING – if you have credit card or other debt, it usually makes sense to pay off this debt first before contributing to savings. The interest rate you will get on savings is likely to be far less than the amount of credit interest you are paying.

ACT – IMPLEMENT YOUR PLAN/ASSESS/ADJUST

Once you have set goals, estimated your fixed and variable expenses and identified monthly savings targets, it is time to put your plan to work.

Give it some time. Then see how you are doing. Were you able to meet your savings goals? If so, stick with it. If not, look at your variable expenses for opportunity areas to cut back spending and increase savings.

Evaluate your plan every three months and make adjustments as needed. If you are not saving enough to meet your monthly goals, you may need to spend less.

Saving is the key to successful financial plans. Use payroll deductions or automatic transfers to checking, savings or money market accounts. It is easier to save if you never see the money.

Use budget plans for paying utilities if they are available. Use cash for purchases rather than charging if you can.

Enter each check you write in a check register. Balance the account every month. If you use a debit card, enter those amounts in your check register.

SELECT A FINANCIAL INSTITUTION

Creating a safety net is easier if you work with a good financial institution such as a credit union or bank.

Interview employees at several locations; look for people who are willing and able to answer your questions. Be ready to talk about the services and the advice you need.

For example, if it is important to you to conduct transactions face-to-face rather than by Automatic Teller Machines (ATM), ask if the financial institution charges for the services of a person at the counter. If you prefer to use ATMs, make sure they are readily accessible and do not charge transaction fees.

Once you select a financial institution, consider opening a checking account if you do not have one. A checking account can save you fees you may now be paying for cashing your paycheck and paying your bills.

START NOW AND STICK WITH IT. YOU WILL FIND THAT BEING SMART ABOUT MONEY IS WELL WORTH IT.

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!

I invite you (beg of you) to celebrate the message within this blog, never the blogger. If IAMAGAYTEKEEPER resonates with you, it's because you already have similar concepts in your heart that I perhaps helped you find and nourish, but they were there all along. The answer is within you, this blog is simply a map to your own heart!